Data-driven research on crypto

Market & project research, video interviews and our weekly newsletter

- Customer stories: Token Terminal’s Data Partnership with Linea

Customer stories: Token Terminal’s Data Partnership with Linea

Through its partnership with Token Terminal, Linea turns transparency into a competitive advantage and continues to build trust with its growing community.

- Introducing Tokenized Assets

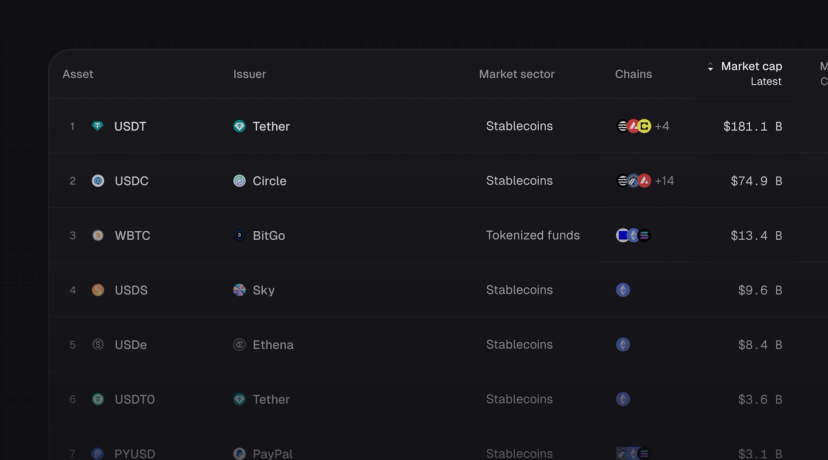

Introducing Tokenized Assets

Token Terminal is expanding its standardized onchain analytics to cover the rapidly growing category of tokenized real-world assets (RWAs) – starting with stablecoins, tokenized funds, and tokenized stocks.

- Customer stories: Token Terminal’s Data Partnership with EigenCloud

Customer stories: Token Terminal’s Data Partnership with EigenCloud

Through its partnership with Token Terminal, EigenCloud turns transparency into a competitive advantage and continues to build trust with its growing community.

- Launching methodologies

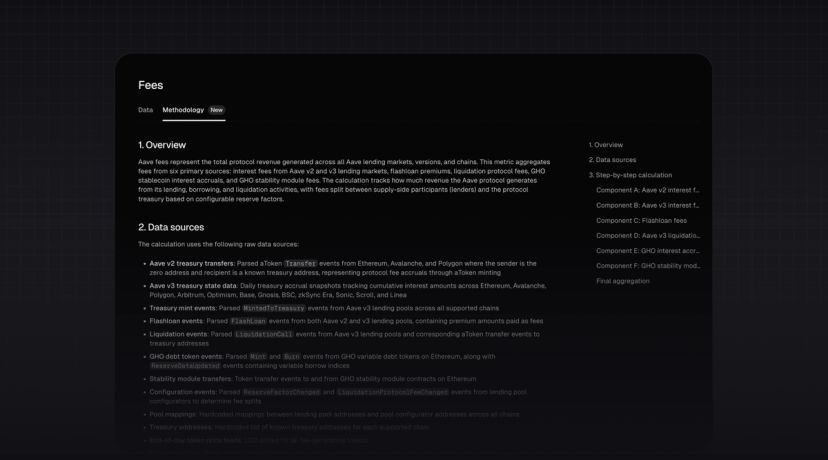

Launching methodologies

Today, we’re launching Methodologies, a new feature on Token Terminal that documents every calculation step between raw blockchain data and standardized financial and usage metrics.

- Expanding the frontier of onchain analytics

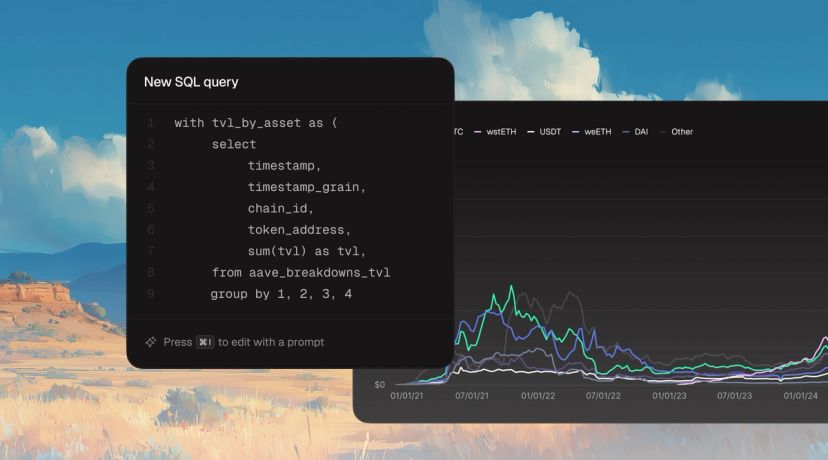

Expanding the frontier of onchain analytics

During Q4, we’re rolling out Queries — a SQL interface designed to complement and extend our existing no-code analytics tools.

Stay in the loop

Join our mailing list to get the latest insights!

- Token Terminal x Alea Research: A partnership to advance the quality and distribution of onchain data & research

Token Terminal x Alea Research: A partnership to advance the quality and distribution of onchain data & research

Through this collaboration, Token Terminal will provide onchain data to Alea Research and support their platform and research reports with standardized and institutional-grade onchain data.

- Customer stories: Token Terminal’s Data Partnership with Ether.fi

Customer stories: Token Terminal’s Data Partnership with Ether.fi

Through its partnership with Token Terminal, Ether.fi turns transparency into a competitive advantage and continues to build trust with its growing community.

- Customer stories: Token Terminal’s Data Partnership with Pendle

Customer stories: Token Terminal’s Data Partnership with Pendle

Through its partnership with Token Terminal, Pendle turns transparency into a competitive advantage and continues to build trust with its growing community.